Tax Consulting

Growth through risk management

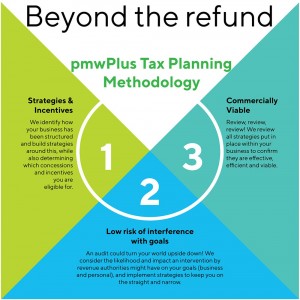

Our tax methodology encompasses a risk-based system which not only works to save you money, but reduces the risk of you becoming targeted by revenue authorities.

Tax governance framework (also called a tax risk management framework), is the guide to how tax risk is addressed in business. We define tax risk as the risk which any tax event, such as investigation review or tax audit, interferes with our ability to meet your goals.

Why the focus on risk?

In January 2017, the ATO published an update to its Tax Risk Management Governance Review Guide. The Guide (first released in 2015), was pitched to target large corporates but since has filtered down to the SME (Small and Medium Enterprise) market.

The update introduced a Directors’ Summary outlining the responsibilities of Directors and Public Officers on their responsibilities regarding Tax corporate Governance. This guide has been modified to be more relevant to equity owners of businesses. It also included guidelines for various other stakeholders with regard to self-assessing their taxation affairs.

The ATO’s “Justified Trust Initiative”, launched mid-2017, reviewed risk ratings of the Top 1,000 companies in Australia. These risk reviews determine what tax governance processes businesses have in place, allowing the ATO to risk rate those businesses.

Companies which have a formal documented tax governance framework in place and where there are controls which monitor compliance with the framework are considered favourably in risk rating.

pmwBusinessCentre Services

No matter the stage of your business, we have a solution for you: