Federal Budget 2020

Key Takeaways for Individuals & Businesses

Last night, Treasurer Josh Frydenburg delivered this years long awaited Federal Budget. Typically presented early in the calendar year, the 2020 Budget was pushed back to October due to the Coronavirus Pandemic.

There is a lot to unpack following last nights announcement, so we’re going to look at the key takeaways and see what they might mean for individuals and businesses.

It’s important to remember that the Federal Budget 2020 proposal is just that – a proposal. Until items proposed in the Budget have received Royal Assent and are legislated, there’s not much to act on.

Okay, let’s dive in and take a look at what the Government’s Federal Budget for 2020. Or if you want a very quick run down, check out the short animated video provided by the Government

For Individuals

- Personal Tax Cuts

From 1 July 2020:

- the Low-Income Tax Offset (LITO), will increase from $445 to $700.

- the top threshold of the 19% tax rate will increase from $37,000 to $45,000, and

- the top threshold of the 32.5% tax rate will increase from $90,000 to $120,000.

Low- and Middle-Income Tax Offset (LMITO), which was due to be removed has been extended to the end of the 2020-2021 year.

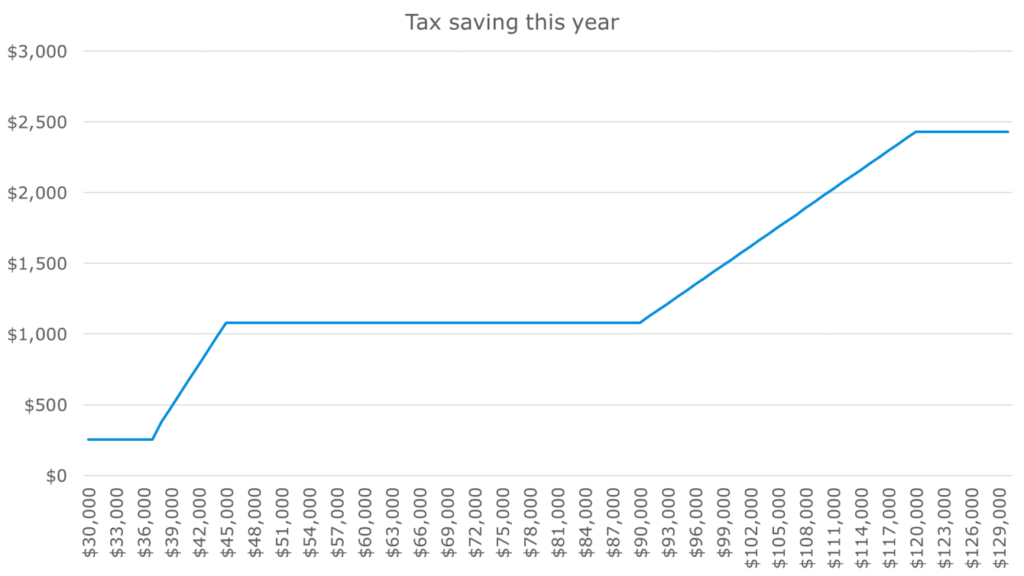

The below chart shows the tax cuts individuals are proposed to receive this financial year based on income levels and current tax settings.

2. Granny Flats exempt from Capital Gains Tax

Capital Gains Tax exemption will be provided for granny flat arrangements where there is a formal written agreement (life-tenancy). This will be applied from the first income year following the date of Royal Assent which enables the legislation.

3. $250 Support Payments

The Government will provide two separate one-off economic support payments of $250 to eligible individuals who receive income support payments or possess concession cards. These payments will be made in December 2020 and March 2021.

For Businesses

1. Temporary full expensing

From 7:30pm AEDT on 6 October 2020 (Budget night) businesses with aggregated annual turnover below the relevant threshold will be able to deduct the full cost of eligible capital assets acquired and first used or installed by 30 June 2022.

- Full expensing in the year of first use will apply to new depreciable assets and the cost of improvements to existing eligible assets for businesses with aggregated annual turnover of less than $5 billion.

- Full expensing also applies to second-hand assets for small and medium-sized businesses with aggregated annual turnover of less than $50 million.

- Full expensing does not apply to second-hand assets for businesses with aggregated annual turnover of $50 million or more.

2. Enhanced instant asset write-off

First used and installed 30 June 2021

Business with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the existing expanded instant asset write-off measure.

The existing enhanced instant asset write-off measure requires an eligible asset to be first used or installed by 31 December 2020 to qualify.

The Government announced that businesses that hold assets eligible for the enhanced $150,000 instant asset write-off will have an extra six months (until 30 June 2021) to first use or install those assets

3. Offset losses from past years

The Government announced it will allow companies with aggregated annual turnover of less than $5 billion to carry back tax losses from 2019-20, 2020-21 or 2021-22 income years to offset previously taxed profits in the 2018-19 or later income years.

The tax refund will be available on election by eligible companies when they lodge their 2020-21 and 2021-22 tax returns.

Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

4. Superannuation reform

For employers

When a person starts a new job and does not nominate a super fund, the employer is now required to contribute to the employees existing super account, rather than the employers preferred super fund.

Employers will be able to retrieve this information from the ATO’s online services.

For now, this is what we perceive as the key takeaways for Individuals and Businesses. We will be sure to keep you up to date as more information is released. Over the next week we can expect to be flooded with commentary and further investigation into these announcements and of course – the Opposition will deliver it’s reply. Watch this space!

For more information, click here.

Source: Economic Recovery Plan for Australia – Budget 2020-2021, Australian Government and Colonial First State, Federal Budget Briefing 2020